November 2025: Cloud Job Market Analysis

December 3, 2025

Job volume decreased 10% over the month.

Multi-Cloud Market Analysis: November 2025

Executive Summary

November 2025 saw a contraction in multi-cloud hiring, with total job volume declining 10% from the start to the end of the month, closing at 818 open roles. Despite this reduction in hiring activity, average salaries increased by 6% to $166,803-- this potentially indicates that while demand for newer roles is down, demand for experienced talent is still strong. Google Cloud Platform (GCP), AWS, and Microsoft Azure are still dominant, Oracle Cloud (OCI) is still quite a distant 4th. Of the cloud platforms, GCP led in average salary at $168,000, followed by AWS at $161,138 and Azure at $153,771. Certifications such as CISSP, SAA-C03, and AZ-305 are consistently in demand.

Monthly Market Overview

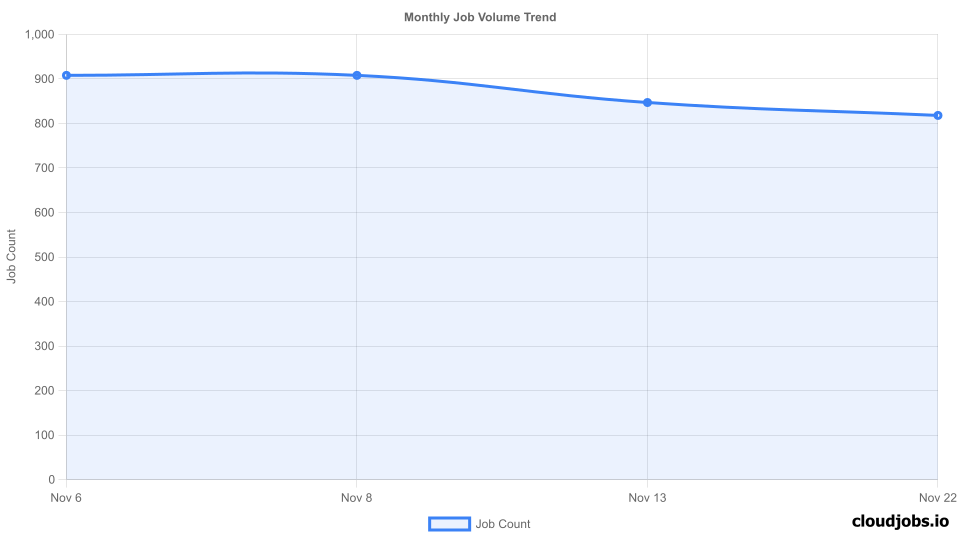

The monthly job volume trend visualization reveals a clear downward trajectory in hiring activity throughout November. The month opened with 908 roles in the first week and maintained this level into the second week. By mid-month, job volume dropped to 847, and by the final week, it reached 818—a 10% decrease from the start. This decline was steady, with no significant rebounds, indicating a cautious approach to hiring as the year-end approached. The trough in the final week aligns with typical seasonal slowdowns, but the overall contraction is sharper than in previous months, suggesting a more selective hiring environment.

The jobs report published on Dec 3rd all but confirmed this downtrend-- private payrolls unexpectedly fell by 32,000.

weekly job count progression throughout the month

weekly job count progression throughout the month

Platform Consistency Analysis

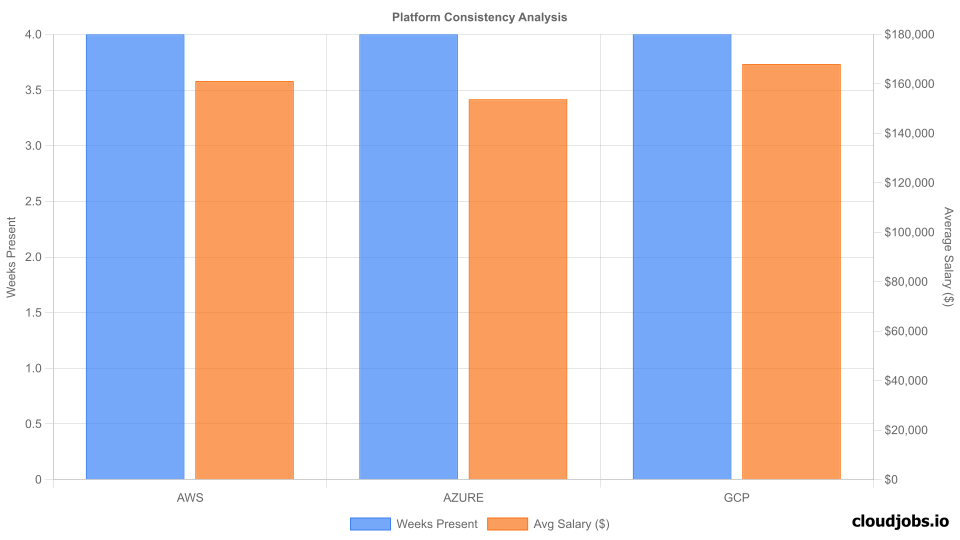

The platform consistency analysis highlights the sustained presence of GCP, AWS, and Azure across all four weeks. GCP led in average salary at $168,000, followed by AWS at $161,138 and Azure at $153,771. These platforms not only maintained high job counts—GCP (399 at peak), AWS (620 at peak), and Azure (532 at peak)—but also demonstrated minimal week-to-week volatility in both job volume and compensation. This consistency underscores their entrenched position in enterprise cloud strategies and the ongoing demand for professionals with expertise in these ecosystems. Oracle Cloud, by contrast, registered no significant hiring activity, confirming its limited market traction in the current cycle.

platform presence and average salary across weeks

platform presence and average salary across weeks

Salary Volatility Assessment

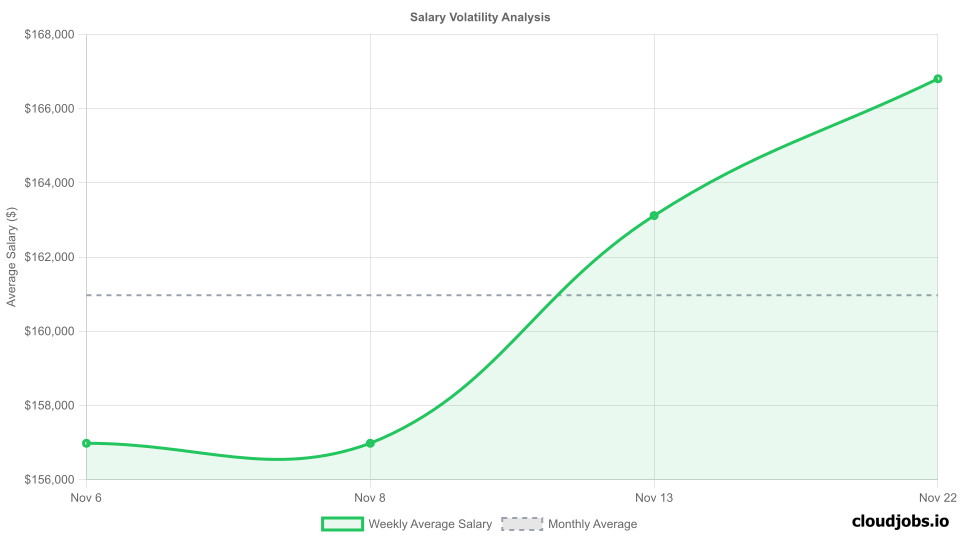

The salary volatility analysis shows that, despite the reduction in job volume, salary levels remained stable and even trended upward. The average salary increased from $156,979 in early November to $166,803 by month-end, a 6% rise. Weekly salary ranges for AWS, Azure, and GCP remained broad but stable, with AWS median salaries moving from $157,500 to $166,500, Azure from $150,187 to $161,410, and GCP from $163,250 to $172,500. The upper quartile for GCP reached $208,547, reflecting strong demand for advanced roles. This stability, coupled with upward movement, suggests that employers are prioritizing quality over quantity, focusing on highly skilled candidates for critical roles.

weekly salary range and volatility across platforms

weekly salary range and volatility across platforms

Technology Leadership Timeline

The technology leadership timeline indicates that no single platform dominated the market outright, with the "Unknown" category leading each week due to the prevalence of multi-cloud and hybrid requirements in job postings. However, the technology ranking trends visualization confirms that GCP, AWS, and Azure consistently ranked as the top three platforms throughout the month. GCP maintained the highest average salary, while AWS and Azure held the largest job shares. This reflects a market where multi-cloud fluency is increasingly expected, and where certifications such as SAA-C03 jobs (AWS Solutions Architect Associate), AZ-305 jobs (Azure Solutions Architect Expert), and GCP-PCSE jobs (Professional Security Engineer) are highly valued.

weekly technology leadership changes throughout the month

weekly technology leadership changes throughout the month

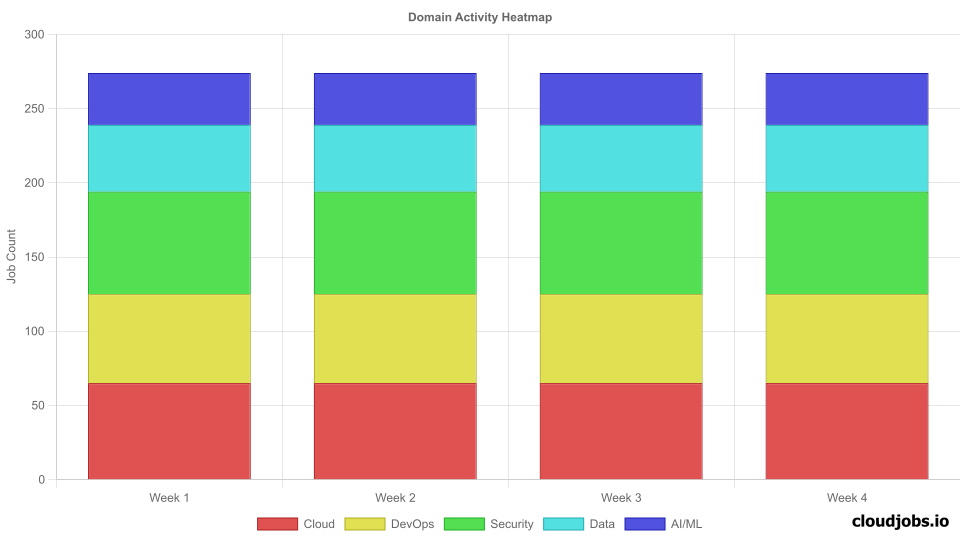

Domain Activity Patterns

The domain activity heatmap demonstrates consistent demand across Security (69 average jobs per week), Cloud (65), and DevOps (60). Security roles, in particular, remained robust, with CISSP - Certified Information Systems Security Professional, SCS-C01 jobs (AWS Security Specialty), and AZ-500 jobs (Azure Security Engineer) among the most requested certifications. Cloud architecture and DevOps roles also maintained steady demand, with AZ-104 jobs (Azure Administrator), AZ-204 jobs (Azure Developer), and AZ-400 jobs (Azure DevOps Engineer) frequently cited. Entry level cloud jobs, while present, accounted for a small fraction of total volume, reflecting the market’s preference for experienced, certified professionals.

domain job activity consistency across weeks

domain job activity consistency across weeks

Key Takeaways & Outlook

- Job Volume: The 10% decline in job postings signals a more selective hiring environment, likely influenced by year-end budget cycles and a focus on critical roles.

- Salary Trends: The 6% increase in average salary, despite lower job volume, highlights ongoing competition for top talent, especially in security and architecture.

- Platform Stability: GCP, AWS, and Azure remain the platforms of choice, with GCP leading in compensation and all three showing strong, stable demand.

- Certification Value: Certifications such as CISSP, SAA-C03, and AZ-305 are consistently in demand, reinforcing the importance of following the aws certification roadmap, azure certification roadmap, and gcp certification roadmap for career advancement.

- Domain Focus: Security, Cloud, and DevOps domains continue to drive hiring, with specialized roles such as AI-102 jobs (Azure AI Engineer), ANS-C01 jobs (AWS Networking Specialty), and GCP-PCSE jobs (Professional Security Engineer) offering premium compensation.

Outlook for December 2025:

Expect continued selectivity in hiring, with a likely further slowdown in job volume due to holiday seasonality. However, salary levels are expected to remain stable or increase for high-demand roles, particularly those requiring advanced certifications. Professionals targeting AWS Certified Cloud Practitioner jobs, AZ-900 jobs (Azure Fundamentals), and GCP-ACE jobs (Associate Cloud Engineer) should focus on upskilling and leveraging aws practice questions, azure practice questions, and gcp practice questions to remain competitive. Hiring managers should anticipate ongoing competition for certified talent, especially in security and architecture, and adjust compensation strategies accordingly.

For more detailed cloud jobs salary data, cloud architect jobs salary benchmarks, and insights into junior cloud engineer jobs, refer to the full CloudJobs November 2025 dataset and visualizations.

SEO Keywords referenced:

AI-102 jobs (Azure AI Engineer), ANS-C01 jobs (AWS Networking Specialty), aws certification roadmap, AWS Certified Cloud Practitioner jobs, AWS cloud, aws jobs, aws practice questions, AZ-104 jobs (Azure Administrator), AZ-204 jobs (Azure Developer), AZ-305 jobs (Azure Solutions Architect Expert), AZ-400 jobs (Azure DevOps Engineer), AZ-500 jobs (Azure Security Engineer), AZ-900 jobs (Azure Fundamentals), azure certification roadmap, Azure DevOps, azure jobs, azure practice questions, cloud architect jobs salary, cloud jobs salary data, DAS-C01 jobs (AWS Data Analytics Specialty), DBS-C01 jobs (AWS Database Specialty), DP-203 jobs (Azure Data Engineer), DP-300 jobs (Azure Database Administrator), entry level cloud jobs, gcp certification roadmap, gcp jobs, gcp practice questions, GCP-ACE jobs (Associate Cloud Engineer), GCP-PCA jobs (Professional Cloud Architect), GCP-PCD jobs (Professional Cloud Developer), GCP-PCDB jobs (Professional Database Engineer), GCP-PCDOP jobs (Professional DevOps Engineer), GCP-PCML jobs (Professional ML Engineer), GCP-PCNE jobs (Professional Network Engineer), GCP-PCSE jobs (Professional Security Engineer), junior cloud engineer jobs, MLS-C01 jobs (AWS Machine Learning Specialty), SAA-C03 jobs (AWS Solutions Architect Associate), SCS-C01 jobs (AWS Security Specialty), Microsoft Azure